The most significant carmaker in the world right now is the Chinese-owned, Warren Buffett-backed company that has Elon Musk in a difficult position: BYD. Once ridiculed by Musk, BYD overtook Tesla at the end of last year as the leading seller of electric vehicles worldwide. While Tesla regained the top spot in the first quarter of this year, the two companies remain neck and neck. BYD is also challenging Toyota with a new hybrid powertrain that it claims can travel from New York to Miami without refueling—a distance of 1,300 miles, far surpassing the standard range for other hybrids on the market, which typically max out at around 680 miles according to The Wall Street Journal.

BYD’s Hong Kong shares surged over 5% on Wednesday. Here’s why this matters:

- Competitive Edge Overseas: Tesla, America’s best-selling EV, is losing market share overseas to competitors who can produce cheaper cars. Despite being an EV pioneer, Tesla hasn’t introduced significant innovations in recent years to justify its higher prices. BYD, which manufactures both EVs and hybrids, is capitalizing on this by outperforming Tesla globally.

- Dominance in China: China is the world’s largest auto market, and BYD has surpassed Volkswagen to become the top seller there. This positions BYD as a significant player not just in EVs but in the automotive industry as a whole.

- Affordability: BYD’s sedans are notably affordable, with models featuring the new drivetrain starting around $14,000. In contrast, the best-selling hybrid in the US, the Toyota Prius, starts at $28,000. This price advantage makes BYD’s vehicles more accessible to a broader range of consumers.

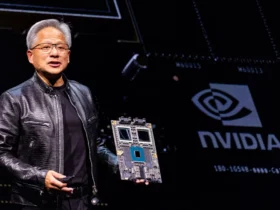

BYD’s rise from a small manufacturer to a global powerhouse has surprised many, including Musk. In a 2011 Bloomberg interview, Musk dismissed BYD with a laugh, questioning the attractiveness and strength of their technology. However, in January, Musk acknowledged on an earnings call that Chinese EV makers could potentially dominate globally unless stronger trade barriers were established.

Unlike Tesla, BYD also produces hybrids, which have proven to be a crucial segment, especially in markets where EV infrastructure is lacking. In the US, EV sales are hindered by insufficient charging stations. Most EVs can travel over 300 miles per charge, but the lack of charging infrastructure deters potential buyers. According to a recent JD Power survey, 52% of US consumers cited the lack of charging stations as the top reason for not considering an EV.

As a result, hybrids, which are generally cheaper than EVs, continue to sell well. They offer reduced fuel costs and are marginally better for the environment than traditional engines. While hybrids still rely on fossil fuels, they represent a more immediately practical solution for many consumers.

Currently, US carmakers, including Tesla, benefit from strict tariffs and regulatory hurdles that limit Chinese competition. However, if American consumers start demanding the more affordable options available overseas, these protections might not hold for long.

Leave a Reply